Smart Financial Services: Modern Auto Insurance for Everyday Drivers

We noticed that many auto insurance companies still rely on outdated systems, like driving a rusty sedan with paper maps. Inspired by our success in personal finance services, we created Smart Financial auto insurance to deliver a modern, fast, and customized experience. Our mission is to simplify auto insurance in the U.S. while helping you save more with Smart Financial.

Compare quotes from top providers

I’ve been reviewing auto insurance companies for a long time, so when I came across a company I hadn’t heard of before called Toggle, I was intrigued. It turns out Toggle is Farmer’s latest brand, and many 21st Century customers are being migrated to it. For everyone else, Toggle is available in just 14 states: Arizona, California, Colorado, Georgia, Illinois, Indiana, Missouri, Ohio, Oregon, South Carolina, Tennessee, Texas, Virginia, and Wisconsin. The company has no local agents. Rather, the entire process, from buying to managing your policy, takes place on its website or via its call center. Is it the right insurance company for you? Let’s decide together.

When it comes to insurance, there’s no one-size-fits-all. If you’re not sure where to start, check out our top picks for the best auto insurance companies.

Smartfinancial Auto Insurance Reviews: Pros and Cons Overview

Pros

-

Fast, user-friendly quote system

-

Discounts for bundling policies

-

Transparent pricing and coverage options

Cons

-

No dedicated mobile app

-

Limited offline customer service

Smartfinancial Auto Insurance Reviews: Who Is It Best For?

Smart Financial Car Insurance: Pricing Overview

Compare Smartfinancial Rates

| Company | Average annual premium for full coverage | Average annual premium for minimum coverage |

|---|---|---|

| National Average | $2,399 | $635 |

| AAA | $3,014 | $1,056 |

| Allstate | $2,605 | $840 |

| American Family | $1,936 | $604 |

| Erie | $1,647 | $581 |

| Farmers | $2,979 | $1,002 |

| GEICO | $1,731 | $517 |

| Nationwide | $1,808 | $718 |

| Progressive | $1,960 | $638 |

| State Farm | $2,167 | $674 |

| Toggle | $3,312 | $1,524 |

| USAA | $1,407 | $417 |

Get Smart Financial Auto Insurance: Ways to Save on Your Policy

You can maximize savings through Smart Financial auto insurance by bundling renters coverage, owning a home, or driving less than 7,500 miles per year.

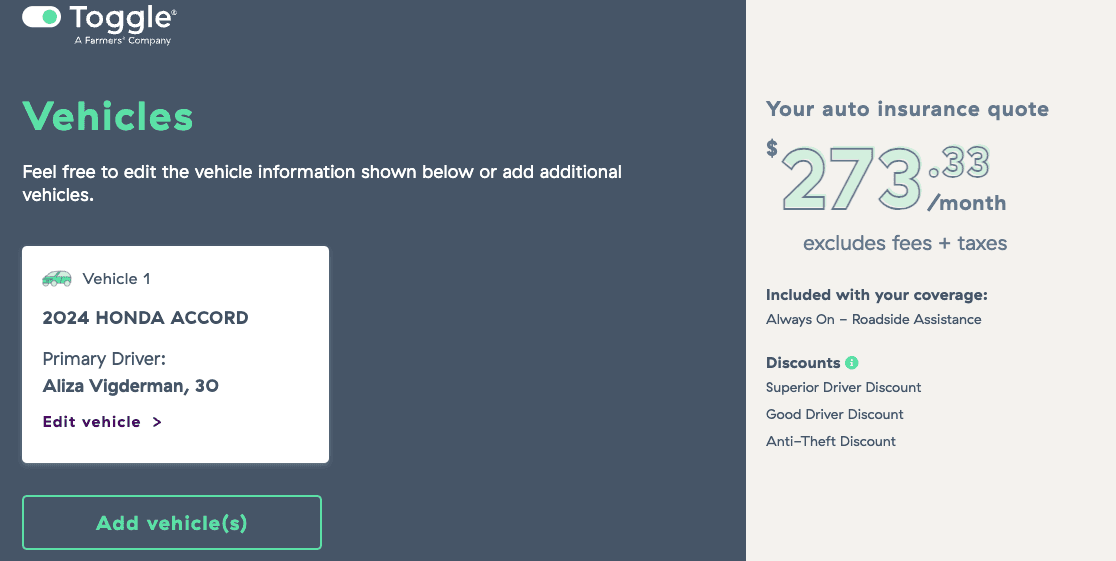

Smartfinancial Auto Insurance Qoute: My Quote Experience

Once I received the quote, I could instantly raise or lower limits, switch deductibles, and see how it affected my premium. Although Smartfinancial pushes for online quotes, they do offer a phone number if you'd rather speak with someone directly.

Prefer face-to-face service? That’s not Smartfinancial’s model — but they do connect you with licensed agents if needed.

Smart Financial Insurance: Coverage and Options Overview

Smart Financial insurance includes all the standard auto coverage options: bodily injury and property damage liability, uninsured/underinsured motorist, collision, comprehensive, personal injury protection, and rental reimbursement. Every policy also comes with free roadside assistance.

What’s not included? Smart Financial doesn’t offer SR-22 filings, non-owner policies, or rideshare coverage. If you drive for Lyft or Uber, or you regularly borrow cars, you’ll need to find another provider that offers those features.

Smart Financial auto insurance is currently available in over 30 states, including:

- Arizona

- California

- Colorado

- Georgia

- Illinois

- Indiana

- Missouri

- Ohio

- Oregon

- South Carolina

- Tennessee

- Texas

- Virginia

- Wisconsin

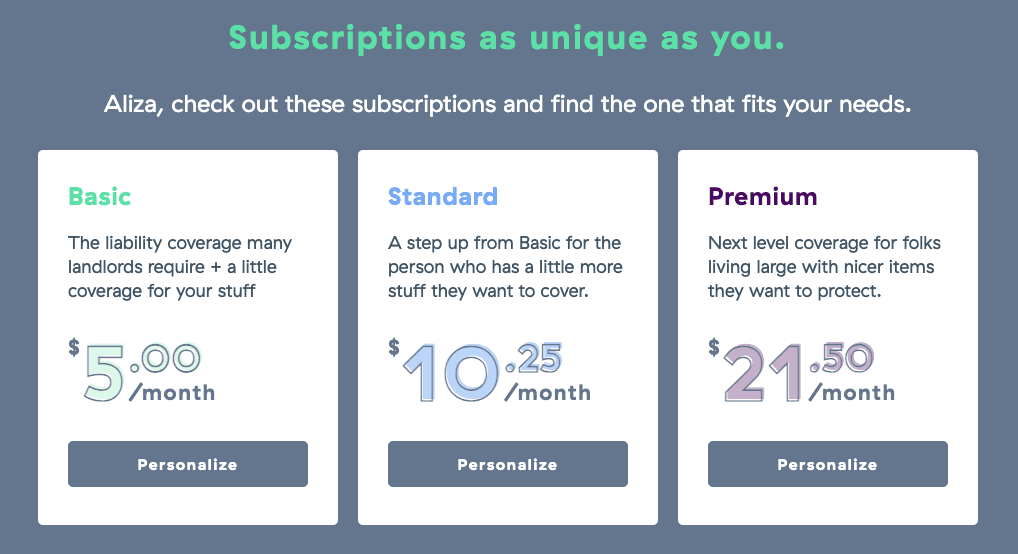

Smart Financial also offers renters insurance — and bundling renters and auto policies qualifies you for a smart financial discount. Some landlords require basic renters insurance, but you can upgrade for added protection of high-value items like laptops, jewelry, or even musical equipment. Optional pet damage protection is also available.

Renters insurance plans start at just $6/month — far below most auto policy rates.

Renters insurance is much cheaper than auto insurance; I got quoted for as little as $5 a month.

Let’s take the lowest-tier plan, which includes a deductible of up to $500 and a liability limit of $100,000. I could have customized my policy, adding coverage for:

- Up to $10,000 for tech gear, fashion accessories, cameras, instruments, fitness equipment,

and collectibles

- Up to $20,000 for household furniture and appliances

In my opinion, it’s smart to go beyond the legal minimum. Premium increases were minor, and in case of fire or theft, replacing everything could cost a fortune.

After choosing my limits, Smart Financial offered several optional add-ons:

- Identity theft: Get notified and protected if your personal info is

leaked.

- Pets: Covers damage to rental properties caused by your pet.

- Replacement: Choose to replace damaged items instead of just repairing

them.

- Side hustle protection: Perfect if you use your laptop or camera for

work.

- Significant other coverage: Add your partner or spouse — even if

unmarried — for free.

Temporary living: Covers hotel stays during property repairs from covered incidents.

DID YOU KNOW?

Smartfinancial Auto Insurance Reviews: Customer Satisfaction Insights

Smart Financial works with a network of licensed providers rather than operating as a single insurer. As a result, customer experience can vary. That said, most partners hold solid reputations, and the platform itself makes policy comparisons simple and transparent.

Still, how does smartfinancial car insurance rank in satisfaction? The service has moderate user reviews on Trustpilot and Google, with many praising its speed and ease of use. Smart Financial itself isn’t rated by J.D. Power, but many of its insurance partners are well-established and financially secure.

| Category | Toggle/Farmers |

|---|---|

| J.D. Power Customer Satisfaction (Farmers) | 617 out of 1,000 in California (average was 637)

624 out of 1,000 in Texas (average was 645)2 |

| AM Best (Toggle) | A (excellent)3 |

| National Association of Insurance Commissioners (Toggle) | 8.91 (nearly 9 times more complaints than expected for a company of its size)4 |

| Moody’s (Farmers) | Stable outlook5 |

| Standard and Poor’s (Farmers) | A |

Smartfinancial Insurance Login App: Customer Support Overview

| Source | Toggle/Farmers Score |

|---|---|

| CRASH Network Insurer Report Card | C-, 78th out of 88 insurers6 |

| J.D. Power Claims Satisfaction Study | 706 out of 1,000 (above average)7 |

Smartfinancial Auto Insurance Login App – Web Experience Without the App

How We Evaluate Auto Insurance — Smart Financial USA and More

To rate smart financial usa as an insurance platform, we look at five key areas:

- Coverage & pricing: Smart Financial offers all standard protections,

plus add-ons. Pricing is competitive, especially for safe drivers.

- Customer satisfaction: Based on partner reviews, user experience is

generally positive.

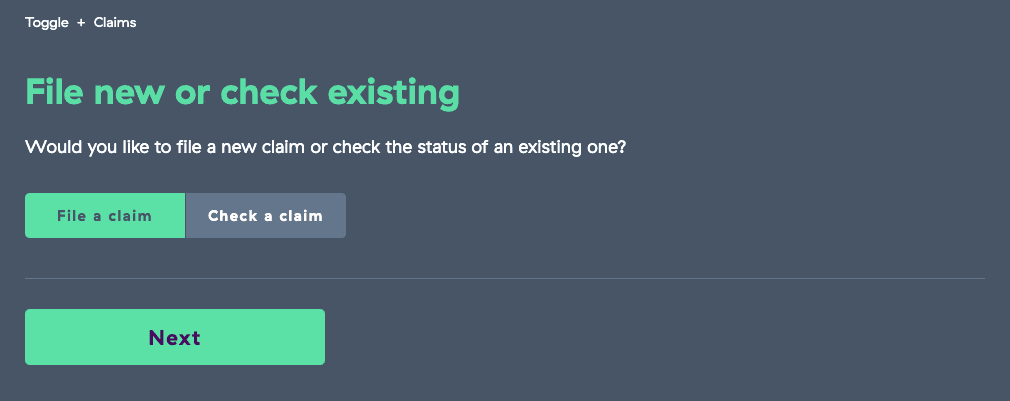

- Claims process: The system is straightforward, with online filing and phone

follow-up.

- Financial strength: Smart Financial only works with providers that are

A-rated or higher.

Digital tools: While there’s no app, the web experience is smooth, and key tools — like quote generation and digital ID cards — are easy to use.